Planned giving leaves a powerful legacy, supporting a healthy future for generations to come. A planned gift is a thoughtful way to give — satisfying your charitable objectives while maximizing tax and other financial and personal benefits. Before committing to a legacy gift to the RVCF, please contact your lawyer and/or financial advisor to achieve maximum benefit for your generosity and most importantly, please discuss your intentions with your family.

Appreciated Securities

A gift of stocks, bonds, mutual funds or other securities is an excellent and financially savvy way to support a cause you believe in. By donating securities directly to the Rideau Valley Conservation Foundation, rather than cashing them and donating the proceeds, you eliminate the capital gains tax; you receive a charitable tax receipt for the full closing value of the securities; and you can make the donation easily – the transfer can be done electronically by your broker from your account to RVCF’s account. If you can't use all of the deduction in one year, you can carry over the remainder for the next five years. Eligible securities include publicly listed stocks, bonds, mutual fund units or exchange traded funds on approved stock exchanges in Canada and internationally.

Life Insurance Policies

The gift of a life insurance policy in which the Conservation Foundation is either owner or named beneficiary may be a convenient way to make a significant deferred gift, especially of an old policy no longer needed by the family. There are a number of life insurance options available and each will have different types of tax benefits. We encourage you to talk to a professional advisor (i.e. your lawyer, financial advisor, accountant, etc.) who can help you decide which option(s) will work best for you and your family.

Annuities & Trusts

Charitable gift annuities and charitable remainder trusts are also practical ways to give. Donors receive a charitable deduction when the gift is made while still providing a steady stream of income to the grantor or beneficiary. The remainder goes to our organization in support of important environmental initiatives upon the donor’s passing.

Land Donations

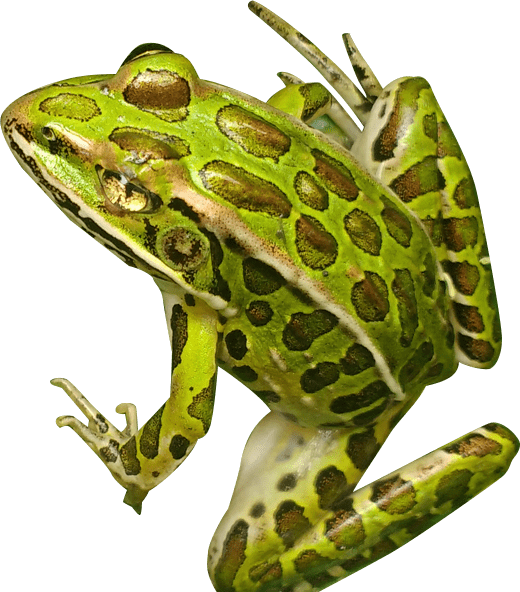

A gift of land may be welcomed by the RVCF. Conservation lands are special places that are protected from development, where the natural world comes first. They are living examples of the natural ecosystems that we strive to protect, supporting critical wildlife habitat and species at risk while working hard to filter our drinking water, protect against flooding and store carbon. Learn more here http://www.rvcf.ca/ways-to-give/land-donation

We strongly encourage our donors, and potential donors, to seek independent and professional advice when executing gifts of securities, property, life insurance, charitable gift annuities, bequests, trusts, contracts and other legal agreements.

If you are interested in discussing the possibility of a planned gift please contact:

Diane Downey

613-692-3571 ext. 1126

This email address is being protected from spambots. You need JavaScript enabled to view it.

Access information on how to make a bequest in your will at https://www.rvcf.ca/ways-to-give/a-bequest-in-your-will.